The Facts About Paul B Insurance Medicare Insurance Program Melville Revealed

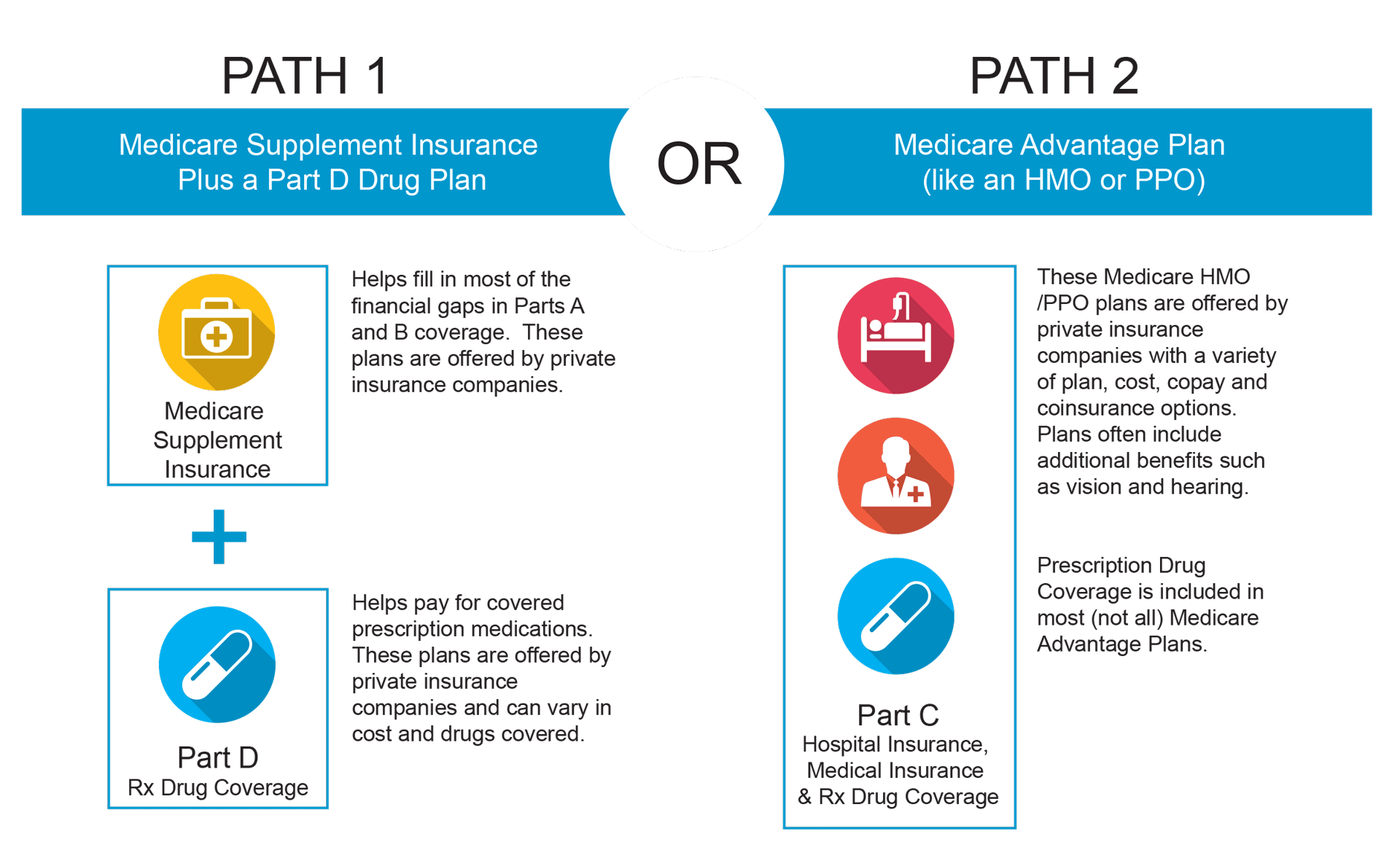

In many cases, you can not keep your stand-alone Medicare Component D strategy as well as the Medicare Benefit strategy. Contrast Medicare Benefit intends to Medigap intends Medicare Advantage intends, Medigap strategies, Are there out-of-pocket prices? Much more out-of-pocket prices, yet may have reduced costs, Fewer out-of-pocket expenses, however may have greater premiums, Where can I make use of the plan? Works only in your state, by area or area, Works in any state, Do I need to utilize the plan's network of carriers? Must use a supplier network, No service provider network required unless you purchase a Medigap Select strategy, Does the plan consist of prescription drug protection (Component D)? A lot of strategies cover Medicare Part DMedicare Part D not included Ask your medical carriers If they'll take the MA plan.

The 7-Minute Rule for Paul B Insurance Insurance Agent For Medicare Melville

In-network companies bill the strategy appropriately and/or refer to Medicaid providers as required. The service providers' workplace knows what Medicaid covers as well as what the strategy covers. You'll have month-to-month premiums to pay. Medicaid will not cover MA plan premiums.

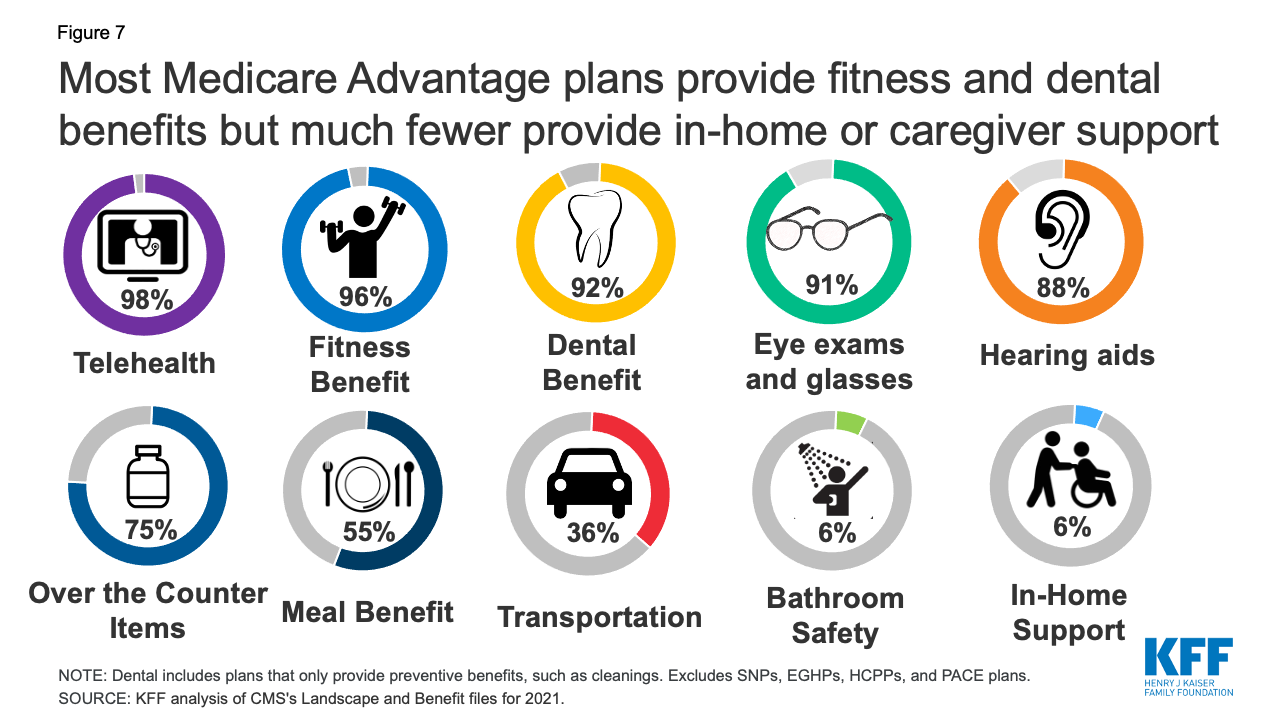

To obtain the exact same insurance coverage with Original Medicare, you would certainly need to purchase a separate prescription medication planand pay a separate premium. Many Medicare Benefit intends cover products not covered by Original Medicare Parts An as well as Bthings like regular dental, vision and also hearing care, prescription medicine protection and in some areas, also health club memberships via a Silver, Sneakers benefit.

That amount varies from strategy to plan and can alter each year. Allow's face itregardless of your existing health and wellness status, you can't anticipate what you might need in the future. Understanding that there's a ceiling to just how much you'll have to spend every year expense might aid you feel extra certain concerning your Medicare plan choice.

More About Paul B Insurance Medicare Advantage Plans Melville

We understand that selecting the appropriate Medicare plan can be a confusing job, with numerous alternatives to consider. You may recognize with Initial Medicare, that includes Medicare Part A (hospital coverage) and also Part B (clinical insurance coverage). There's a choice that goes beyond what Original Medicare has to offer a Medicare Advantage plan.

Medicare Benefit strategies can supply even more value than Original Medicare alone. Since private insurance companies like Anthem supply Medicare Advantage prepares, you likewise have more versatility with your strategy choice.

Paul B Insurance Medicare Supplement Agent Melville for Beginners

Discovering the very best Medicare Advantage strategy might deserve it for the extra coverage. Be certain to ask the appropriate concerns to obtain one of the most out of the plan you choose. Doctors and healthcare facilities in a plan's network can transform yearly, so it's finest to make sure your family practitioner is still in the plan after your initial registration.

You can use our discover a drug device to see what medicines are offered in the plan. If you need medications, are they available and also cost effective under a picked plan? Medicare Benefit intends restriction just how much their participants pay of pocket for covered Medicare expenditures. That quantity her comment is here varies depending on the plan you select.

Picking a plan with a lower out-of-pocket optimum might be more effective to make certain you have coverage for unanticipated injuries or ailments.

6 Easy Facts About Paul B Insurance Medicare Health Advantage Melville Explained

Medicare is a federal health insurance program that pays many of the health treatment costs for people that are 65 or older. paul b insurance local medicare agent melville. It will certainly likewise spend for healthcare for some people under age 65 that have disabilities. You can acquire Medicare supplement insurance coverage to aid pay some of your out-of-pocket prices explanation that Medicare won't pay.

Medicare supplement policies only work with initial Medicare. Home health and wellness treatment. Residence health and wellness care.

The Medicare Component A benefit duration begins the very first day you receive a Medicare-covered service as well as ends when you have actually been out of the healthcare facility or a skilled nursing home for 60 days in a row. For Medicare parts An and also B, you pay monthly costs, and deductibles, copays, and also coinsurance.

How Paul B Insurance Medicare Agency Melville can Save You Time, Stress, and Money.

are quantities you pay to keep your Medicare coverage - paul b insurance Medicare Advantage Agent melville. Many people do not need to pay a Component A costs, yet everybody needs to pay the Part B costs. The premium amounts may transform annually in January. A is the amount you should pay for clinical expenses before Medicare begins to pay.